From GCash to MariBank, Comfort Meets Its Cracks

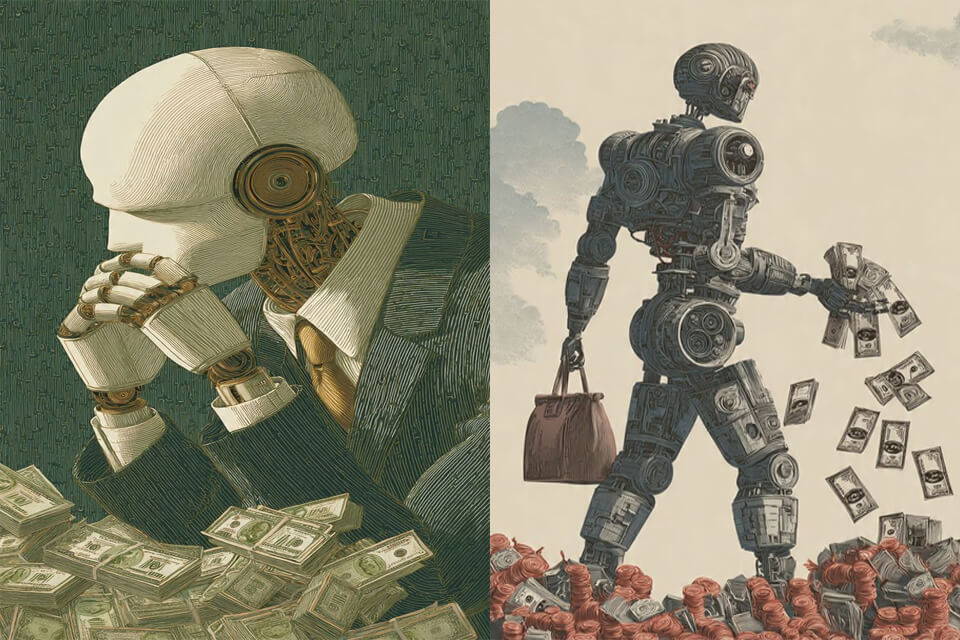

📖 Abstract: The Paradox of Perfect Frictionlessness

The rise of virtual banking in the Philippines—GCash, Maya, GoTyme, and MariBank (made famous by Jose Mari Chan’s YouTube serenades and social media ads)—promised pure comfort. It was the perfect antidote to the Friction component of the Old Grammar of Money: no queues, no traffic, no counting physical change.

During the pandemic, these platforms became lifelines. Bills were paid without leaving home, remittances flowed across islands, and sari-sari stores suddenly had QR codes taped to their counters. Comfort was digitized.

Yet this digital utopia birthed a new set of problems: Analog Anxiety. The very convenience that sped up our transactions also accelerated our spending, erased our financial consciousness, and replaced frustrating human tellers with impersonal customer service black holes.

Artificial Intelligence is not needed to accelerate payments—that’s already solved. AI is needed to debug the human woes created by the perfect, frictionless system. True comfort is not just speed; it is the elimination of financial anxiety.

🏦 The Digital Dream: When Convenience Became King

The pandemic forced our financial existence online, and the infrastructure responded with astonishing speed. Local wallets and banks became essential, moving the Philippine economy from the jeepney line to the QR code.

The value proposition was irrefutable: zero effort. Sending money became instantaneous. The overwhelming comfort was that we had removed the physical barriers to capital flow. We broke the grammar rule of Friction is Value and replaced it with Frictionlessness is Freedom.

But this freedom carried a hidden cost: The Invisibility of Money.

⚠️ The Woes of Comfort: Analog Anxiety in a Digital World

The new banking ecosystem is a perfect machine for transactional speed, but a terrible one for psychological well-being. By moving money into the ethereal digital cloud, we lost the tangible markers that forced us to slow down and think.

And when the system itself falters, the anxiety multiplies. Just recently, GCash announced that some of its services were unavailable due to technical issues. For millions of Filipinos who rely on the app for bills, remittances, and daily purchases, the downtime was more than an inconvenience—it was a reminder that the comfort of virtual money is fragile. The invisible nature of digital transactions means that when the system stalls, users are left in limbo, staring at screens and wondering if their money has vanished into the ether.

Source: ABS-CBN News – GCash says some services unavailable (Nov 21, 2025)

A. The Budgetary Blackout

Paying in cash forced awareness: seeing bills leave your wallet was a momentary stop. With virtual money, transactions are painless clicks, divorced from the concept of loss. The comfort of the click leads to the anxiety of the Post-Transaction Reveal—checking your balance later and realizing the digital flow was too fast to monitor.

B. The Customer Service Black Hole

Digital banks eliminated human tellers and queues, but installed the AI Chatbot Wall. When a transfer fails or an account locks, problems are handled by infinite loops of empathetic-sounding text. Friction is gone, but accountability is gone too. Users are left screaming at machines that never listen—an Isolation Penalty of the optimized system.

C. The Vigilance Tax (Security Fatigue)

We traded the single anxiety of holding cash for constant paranoia: PINs, OTPs, phishing scams, app lockouts, mandatory updates. Comfort now comes with a Vigilance Tax—a permanent state of low-grade financial anxiety.

🤖 AI as the True Comfort Engineer

If the first wave of digital banking solved Friction, the next wave must solve Anxiety. AI is required not for speed, but for deep, personalized context.

A. AI Financial Guardrails (Solving the Blackout)

A true AI-Native finance platform automates attention. It uses spending history and goals to calculate a Digital Comfort Limit. Before you click, it warns: “This ₱1,500 purchase will spike your monthly anxiety by 20%. Proceed?” Transactions become contextual consequences, not abstract acts.

B. The AI Woes Solver (Debugging the Black Hole)

Customer service voids can be closed by predictive resolution. An AI Woes Solver monitors transactions for anomalies. If a transfer fails, it auto-detects, auto-credits, and auto-sends a resolution timeline—before you even notice. Service becomes silent, seamless, and anxiety-free.

C. Adaptive Security (Erasing the Vigilance Tax)

AI takes over vigilance. Behavioral biometrics (typing style, login patterns, location) create risk profiles. If it’s 99% “You,” transactions are invisible and instant. If suspicious, AI locks the account and escalates to human verification via secure video—without burdening you with new codes.

🧒 Too Cryptic? Explain Like I’m 12

Imagine you have a magic wallet on your phone. You can buy snacks, pay bills, or send money without leaving home.

But sometimes the wallet glitches, or someone tries to trick you. That’s scary.

AI is like a smart guardian for your wallet. It spots scams, explains things clearly, and helps you save. It makes the magic wallet safer and smarter.

📢 Conclusion: Trading Convenience for Serenity

The transition to virtual money gave us a powerful, frictionless engine for transactions. But convenience, when divorced from consciousness, leads to anxiety.

The ultimate promise of AI in finance is not the optimization of speed, but the optimization of serenity. It is the final step in automating not just the work of money, but the worry of money.

We are finally moving from the Digital Peso to the AI-Native Calm—where systems are so smart, you never have to think about them again.

Welcome to AIWhyLive.com, where we calculate the true cost of convenience.