Introduction: The Timeless Wisdom of Robert Kiyosaki

Robert Kiyosaki’s Rich Dad, Poor Dad has shaped financial mindsets for decades, teaching people the difference between working for money and making money work for them. The book’s core lessons—financial literacy, asset-building, and escaping the rat race—remain relevant today. But as we enter the Age of AI, do these principles still apply? Or has artificial intelligence changed the game entirely?

The Core Lessons of Rich Dad, Poor Dad

Kiyosaki’s book contrasts two financial philosophies:

- Poor Dad: His biological father, who believed in traditional education, job security, and saving money.

- Rich Dad: His mentor, who emphasized financial education, investing, and entrepreneurship.

The book teaches that wealth isn’t built by working harder—it’s built by leveraging assets, understanding money, and making strategic investments. It also challenges the idea that formal education alone guarantees success, arguing that financial intelligence is just as crucial.

AI and the Evolution of Wealth-Building

Fast forward to today, and AI is reshaping industries, careers, and financial strategies. The question is: Does Rich Dad’s advice still hold up in an AI-driven world? The answer is a resounding yes—but with new opportunities and challenges.

1. AI as an Asset, Not a Liability

Kiyosaki teaches that assets generate income, while liabilities drain it. In the AI era, businesses and individuals must ask:

- Is AI an asset that increases productivity and revenue?

- Or is it a liability—something expensive that doesn’t generate returns?

For entrepreneurs, AI can automate tasks, optimize investments, and create passive income streams, making it a powerful asset when used strategically.

2. Escaping the Rat Race with AI

One of Kiyosaki’s key lessons is escaping the cycle of working for a paycheck. AI accelerates this possibility by enabling automation, freelancing, and digital entrepreneurship. Filipinos can now leverage AI to:

- Build online businesses that generate passive income.

- Use AI-powered investment tools to grow wealth.

- Automate side hustles to free up time for higher-value activities.

Instead of fearing AI replacing jobs, Filipinos can use AI to create new income streams, aligning perfectly with Rich Dad’s philosophy.

3. Financial Education in the AI Era

Kiyosaki stresses that schools don’t teach financial literacy, and that’s still true today. But now, AI-powered platforms can educate Filipinos on investing, budgeting, and wealth-building in ways never before possible.

- AI-driven financial advisors can help users make smarter investment decisions.

- AI-powered learning platforms can teach financial strategies tailored to individual needs.

- AI-enhanced market analysis can provide real-time insights for better financial planning.

In short, AI doesn’t replace financial education—it enhances it.

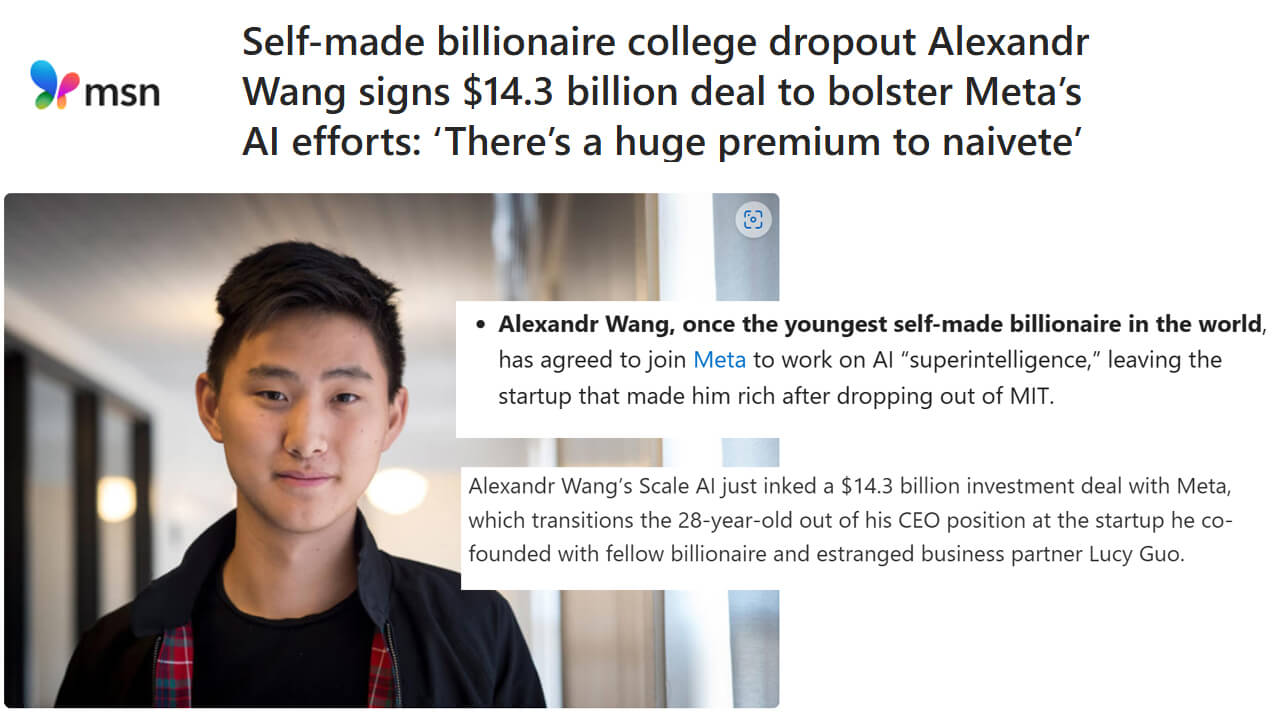

College, Success, and the AI Disruption

Kiyosaki’s book challenges the traditional belief that a college degree guarantees success. Today, this debate is more relevant than ever, as AI disrupts conventional career paths. As explored in Is College Still Worth It? What Gen Z Tech Founders and Filipino Learners Are Starting to Believe, many young professionals question whether formal education is the best route to financial stability.

Similarly, AI Disrupts Traditional Success highlights how AI reshapes industries, making skills-based learning and adaptability more valuable than degrees alone. While education remains important, success today is increasingly defined by how well individuals leverage AI, digital tools, and entrepreneurial thinking, not just by diplomas.

For Filipinos, this shift presents both challenges and opportunities. AI-driven careers, freelancing, and digital entrepreneurship offer new ways to build wealth without following the traditional college-to-corporate path. The key takeaway? Success in the AI era isn’t about credentials—it’s about adaptability, financial intelligence, and strategic thinking.

Conclusion: The Timeless Truth of Wealth-Building

As Kiyosaki famously said: > “The poor and middle class work for money. The rich have money to work for them.”

This principle still applies in the AI era—but now, AI itself can be the tool that makes money work for you. Whether you’re an entrepreneur, investor, or employee, the key is leveraging AI as an asset rather than fearing it as a threat.

In the end, Rich Dad, Poor Dad isn’t just about money—it’s about mindset. And in the age of AI, the biggest advantage isn’t just financial intelligence—it’s the ability to adapt, innovate, and embrace new opportunities.

Sources

- Is College Still Worth It? What Gen Z Tech Founders and Filipino Learners Are Starting to Believe

- AI Disrupts Traditional Success

- 5 Reasons Why Every Filipino Must Read Rich Dad Poor Dad

- A Reflection on Rich Dad Poor Dad by Robert Kiyosaki

- Book Review: Rich Dad, Poor Dad – Gregory Books

This article bridges timeless financial wisdom with AI-driven opportunities, ensuring that Kiyosaki’s lessons remain relevant for Filipinos navigating the digital future.